Singapore, 30 January 2026– The Singapore property auction market saw increased activity in 2025, with the number of properties listed for auction reaching a four-year high, driven largely by an increase in the number of mortgagee-sale listings.

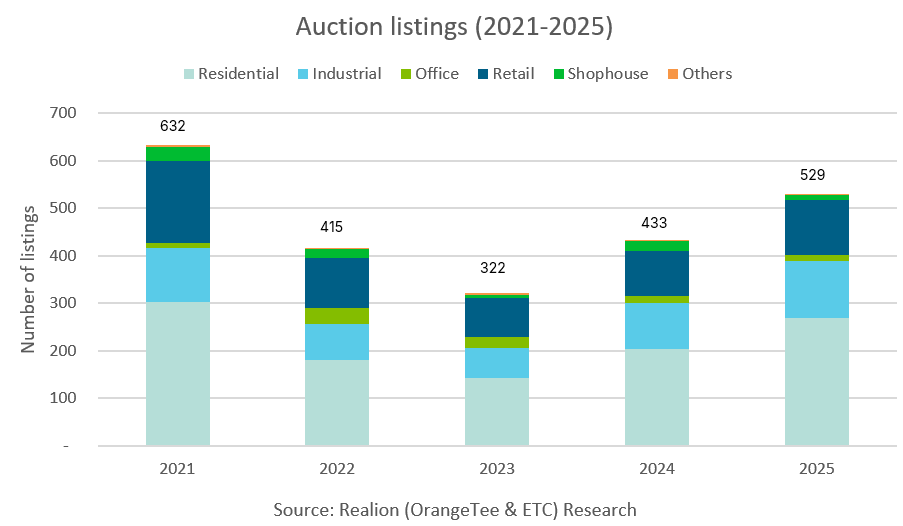

A total of 529 properties were listed for auction in 2025, up 22.2% from 433 listings in 2024, marking the highest annual auction listing volume since 2021. The increase highlighted a dynamic property auction market, offering a wide range of opportunities for buyers and investors.

Mortgagee-sale listings increased in 2025

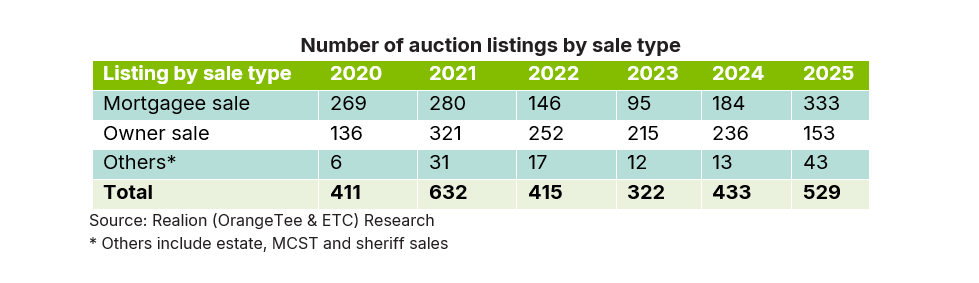

Mortgagee-sale listings accounted for 333 properties, or 62.9% of total listings, up from 184 in 2024. Owner-led listings declined to 153 units, representing 28.9% of total listings.

Ms Joy Tan (陈紫萍), Head of Auction & Sales at ETC, a member of Realion Group, says, “The increase in auction listings in 2025 reflected the continued use of auctions by both property owners and financial institutions as a transparent and effective sales platform. While owner-sale listings have historically dominated auction activity, the higher proportion of mortgagee-sale listings in 2025 can be attributed in part to tighter financing conditions and a more cautious economic environment, instead of a fundamental shift in seller behaviour. The only other instance in recent years where mortgagee-sale listings exceeded owner-sale listings was in 2020, a year of market disruptions that briefly shifted auction dynamics.”

Trends across property types

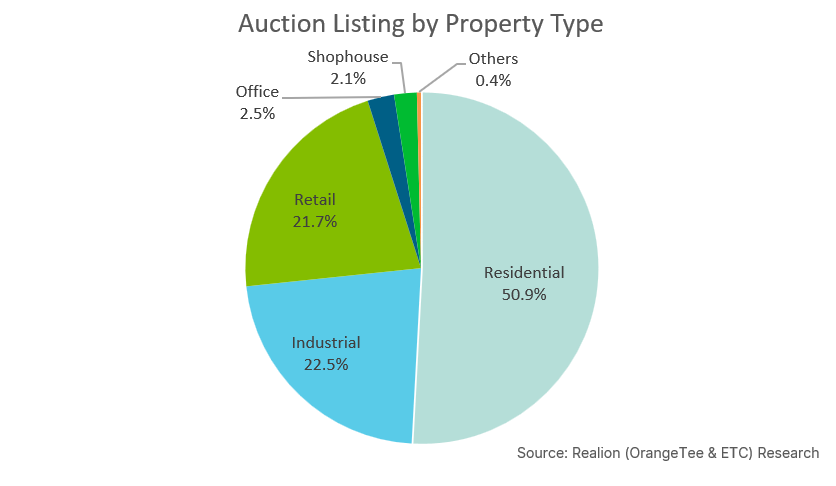

Residential properties continued to make up the bulk of auction listings, accounting for 50.9% of total listings, followed by industrial properties (22.5%), retail units (21.7%), and office assets (2.5%).

Within residential, it was observed that there were more smaller shoebox and one-bedroom apartment units, as well as some high-value homes above S$5 million, being put up for auction – providing buyers with a range of entry points across different price brackets.

Ms Tan adds, “The wide range of residential properties available for auction reflects the diversity of seller motivations. Some may be navigating tighter cash-flow positions due to higher mortgage rate locked in over the past 2-3 years, while owners of high-value homes are turning to auction as an additional way to reach a broader pool of serious buyers and to achieve optimised pricing outcomes in a measured market.”

Sales performance

The higher number of auction listings translated into an improved auction success rate. In 2025, 24 properties were sold at auction, up from 15 in 2024, lifting the success rate to 4.5%, compared with 3.5% a year earlier.

Total transaction value at auction reached S$64.8 million in 2025, representing a 126% increase year-on-year. This could be attributed to the successful sale of several high-value properties of more than S$5 million.

Some notable high-quantum properties that were sold this year included:

- A freehold 3-storey B1 terrace factory at Tagore Industrial Avenue, sold at S$9.08 million, above its opening price

- A 4-bedroom apartment at The Sovereign at 99 Meyer Road sold for S$7.7 million

- A freehold 2-storey detached house along Brighton Avenue sold for S$7.6 million

- A 2-storey corner terrace house along Hythe Road sold for S$6.5 million

Outlook

Looking ahead, the property auction market is expected to remain active in 2026, with a possible uptick in high-quantum listings as some owners recalibrate their asset-holding strategies amid evolving regulatory, financing and market conditions.

At the same time, the increased supply of new project completions could exert mild downward pressure on rental prices, which may affect owners’ ability to rely on rental income to service their loans. Coupled with ongoing macroeconomic uncertainties and cautious business sentiment, these factors are likely to shape overall market activity in the year ahead, even as owner-sale listings stabilise on the back of projected interest rate moderation in the second half of the year.

END